All Categories

Featured

Table of Contents

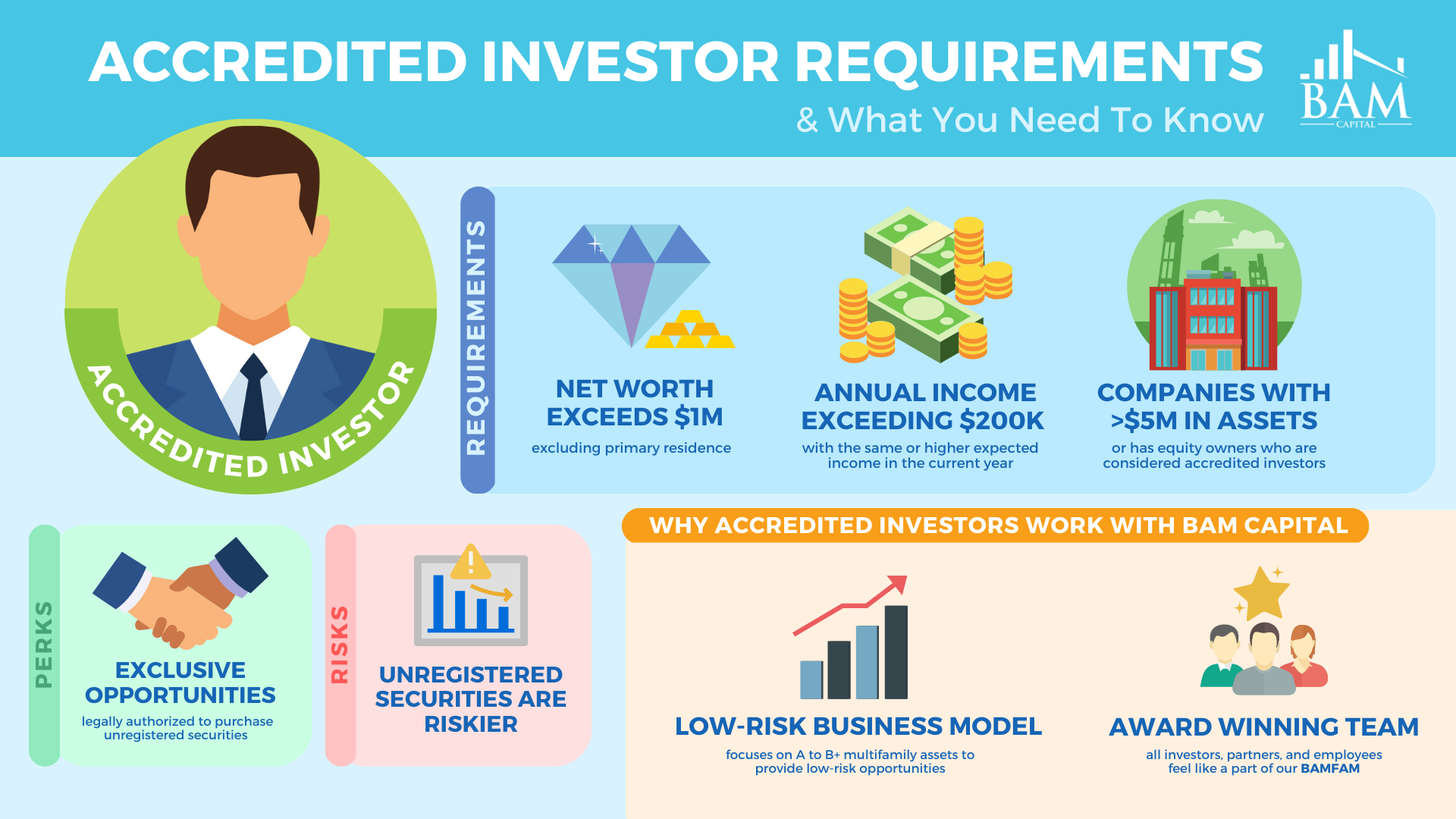

As accredited financiers, people or entities may partake in exclusive financial investments that are not signed up with the SEC. These capitalists are presumed to have the financial elegance and experience called for to review and invest in high-risk investment chances hard to reach to non-accredited retail financiers. Right here are a few to think about. In April 2023, Congressman Mike Flooding presented H (real estate investing for accredited investors).R

For now, investors must follow by the term's existing meaning. Although there is no official process or government qualification to come to be a recognized financier, an individual may self-certify as an accredited financier under current policies if they gained greater than $200,000 (or $300,000 with a spouse) in each of the previous two years and expect the very same for the current year.

People with an energetic Series 7, 65, or 82 permit are likewise considered to be certified capitalists. Entities such as firms, partnerships, and counts on can additionally attain certified financier condition if their investments are valued at over $5 million. As accredited investors, individuals or entities may partake in exclusive financial investments that are not registered with the SEC.

Here are a few to consider. Private Equity (PE) funds have revealed remarkable growth recently, apparently undeterred by macroeconomic challenges. In the third quarter of 2023, PE offer quantity surpassed $100 billion, approximately on the same level with offer task in Q3 of the previous. PE companies swimming pool resources from accredited and institutional financiers to obtain regulating rate of interests in fully grown exclusive companies.

Along with capital, angel investors bring their expert networks, assistance, and proficiency to the start-ups they back, with the assumption of venture capital-like returns if the organization takes off. According to the Facility for Venture Study, the average angel financial investment quantity in 2022 was approximately $350,000, with capitalists obtaining a typical equity stake of over 9%.

Proven Accredited Investment Platforms Near Me – Santa Ana

That stated, the arrival of online private credit score platforms and particular niche enrollers has actually made the asset class obtainable to specific accredited investors. Today, investors with just $500 to spend can benefit from asset-based private credit rating chances, which offer IRRs of as much as 12%. Regardless of the rise of e-commerce, physical food store still represent over 80% of grocery sales in the USA, making themand especially the genuine estate they operate out oflucrative financial investments for recognized capitalists.

In comparison, unanchored strip centers and area centers, the next 2 most heavily negotiated kinds of property, taped $2.6 billion and $1.7 billion in transactions, specifically, over the exact same period. However what are grocery store-anchored centers? Suburban shopping center, outlet shopping centers, and various other retail facilities that feature a major grocery store as the place's primary occupant usually fall under this group, although shopping centers with encased sidewalks do not.

To a minimal degree, this phenomenon is likewise true in opposite. This distinctly symbiotic relationship in between a center's occupants drives up need and maintains leas elevated. Certified investors can buy these areas by partnering with genuine estate exclusive equity (REPE) funds. Minimum investments normally start at $50,000, while total (levered) returns vary from 12% to 18%.

Reliable Opportunities For Accredited Investors

Over the last years, art has earned ordinary yearly returns of 14%, trouncing the S&P 500's 10.15%. The market for art is also expanding. In 2022, the global art market grew by 3% to $67.8 billion. By the end of the years, this figure is anticipated to approach $100 billion.

Investors can now possess diversified personal art funds or purchase art on a fractional basis. accredited investor funding opportunities. These choices come with financial investment minimums of $10,000 and use net annualized returns of over 12%.

Over the previous several years, the certified investor definition has been criticized on the basis that its sole focus on an asset/income test has unjustly left out all however the most affluent individuals from financially rewarding investment opportunities. In reaction, the SEC started taking into consideration methods to increase this meaning. After an extensive remark period, the SEC adopted these modifications as a method both to record individuals that have dependable, different signs of economic elegance and to improve certain out-of-date sections of the meaning.

The SEC's main concern in its regulation of non listed safeties offerings is the security of those capitalists that do not have an adequate level of monetary refinement. This problem does not relate to educated staff members because, by the nature of their setting, they have adequate experience and access to financial details to make educated financial investment decisions.

Profitable 506c Investment (Santa Ana CA)

The identifying variable is whether a non-executive employee really takes part in the private investment firm's investments, which have to be determined on a case-by-case basis. The enhancement of educated employees to the accredited financier meaning will certainly likewise enable more staff members to purchase their employer without the personal investment firm risking its own standing as an accredited investor.

Before the changes, some private financial investment business took the chance of shedding their accredited capitalist standing if they allowed their staff members to invest in the firm's offerings. Under the amended definition, a higher number of private investment firm employees will certainly currently be eligible to invest. This not just produces an additional resource of funding for the private investment business, yet also additional aligns the interests of the worker with their employer.

Best Investment Opportunities For Accredited Investors Near Me (Santa Ana CA)

Presently, only individuals holding specific broker or monetary expert licenses ("Series 7, Collection 65, and Collection 82") qualify under the interpretation, yet the modifications give the SEC the ability to consist of extra qualifications, classifications, or credentials in the future. Specific kinds of entities have likewise been included in the interpretation.

The enhancement of LLCs is likely the most notable addition. When the meaning was last upgraded in 1989, LLCs were fairly rare and were not included as an eligible entity. Because that time, LLCs have actually ended up being very common, and the definition has been modernized to show this. Under the amendments, an LLC is thought about an accredited investor when (i) it contends least $5,000,000 in possessions and (ii) it has actually not been formed only for the particular objective of getting the protections supplied.

In a similar way, particular family workplaces and their customers have actually been contributed to the interpretation. A "family office" is an entity that is developed by a family members to handle its possessions and attend to its future. To ensure that these entities are covered by the meaning, the modifications state that a household office will certainly now qualify as a certified investor when it (i) takes care of at least $5,000,000 in possessions, (ii) has not been created especially for the function of getting the provided protections, and (iii) is directed by a person that has the monetary elegance to evaluate the qualities and risks of the offering.

The SEC asked for comments relating to whether the financial thresholds for the income and property tests in the meaning should be changed. These limits have been in area given that 1982 and have not been adjusted to account for rising cost of living or other elements that have changed in the interfering 38 years. However, the SEC ultimately made a decision to leave the property and income limits unmodified for now.

Table of Contents

Latest Posts

Delinquent Tax Sale

Tax Lien Investing Expert

Tax Lien Certificates List

More

Latest Posts

Delinquent Tax Sale

Tax Lien Investing Expert

Tax Lien Certificates List